The Greatest Guide To Payment Processing

Table of ContentsThe smart Trick of Payment Processing That Nobody is Talking AboutRumored Buzz on Payment ProcessingLittle Known Questions About Payment Checkup.Payment Checkup Fundamentals ExplainedThe 3-Minute Rule for Online Payment SystemsThe Best Strategy To Use For Online Payment SystemsAbout Merchant AccountMore About Online Payment SystemsNot known Facts About Payment Solutions

The most common issue for a chargeback is that the cardholder can not keep in mind the deal. However, the chargeback ratio is really low for purchases in an in person (POS) environment. See Chargeback Monitoring.You don't need to end up being a specialist, but you'll be a much better customer if you recognize exactly how credit card processing really works. Who are the stars in a credit score as well as debit card deals?

The smart Trick of Online Payment Systems That Nobody is Talking About

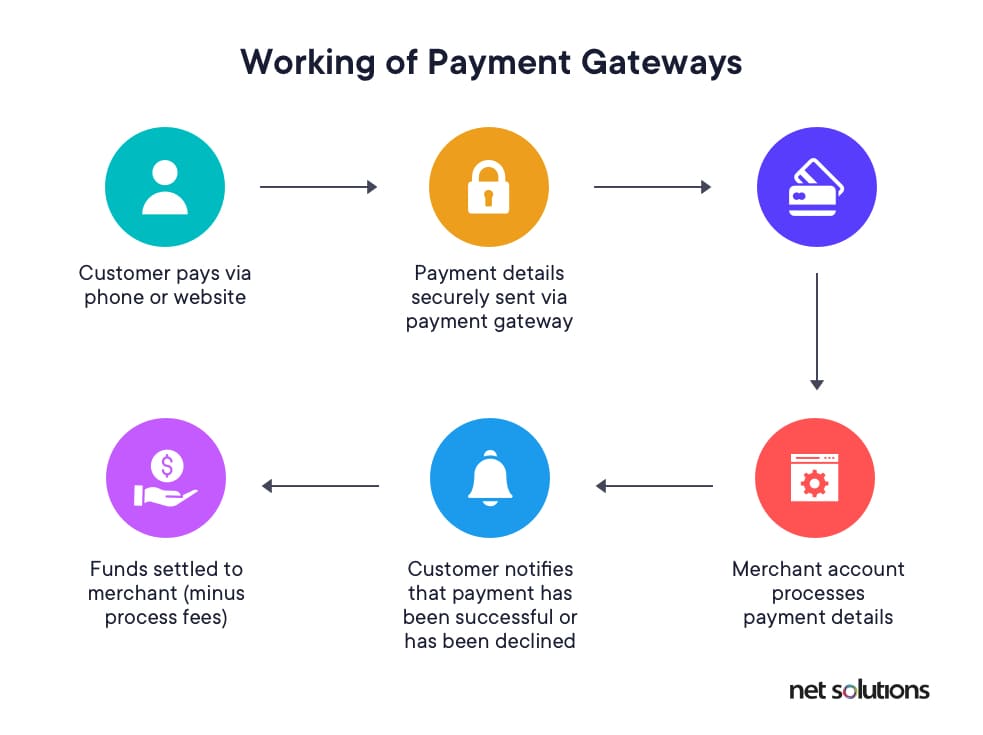

That's the credit rating card process in a nutshell. The costs the account for the quantity of the purchases. The after that transfers suitable funds for the deals to the, minus interchange charges.

Here's where payment handling industry is available in helpful. It does not matter whether you have a physical store or job using the internet only or whether you're involved in the resort business or monetary services. You need to understand the how-to's of contactless settlement processing and online repayment software program if you appreciate your organization.

Rumored Buzz on Payment Checkup

You can receive a merchant account using a settlement handling business, an independent specialist, or a large bank. Without it, you would certainly have nowhere to maintain the cash your consumers pay you. A settlement processing firm or monetary organization deals with the deals between your customers' financial institutions and also your bank. They handle such concerns as charge card validity, offered funds, card limits, and more.

You ought to permit sellers to accessibility details from the backend so they can see background of settlements, terminations, as well as various other purchase information. You have to comply with the PCI Safety And Security Requirements to give web site settlement handling services for clients. PCI Safety and security assists suppliers, sellers, as well as banks execute criteria for developing safe and secure settlement remedies.

Everything about Payment Processor

Yes, there was a time when normal card payment handling software application satisfied the major demands of small companies. Points have changed, and the repayment handling software application market has broadened considerably. This suggests that you do not have to go for less advanced site repayment processing systems that aren't precisely what you need.

Various other drawbacks include high rates for some types of settlement processing, constraints on the number of purchases per day as well as quantity per purchase, and also safety holes. There's additionally a variety of online settlement handling software (i.

merchant accountsSeller sometimes with a payment gateway)Portal One more selection is an open source repayment processing system.

Things about Merchant Account

They can likewise make your money flow much more foreseeable, which is something that every small company owner strives for. Locate out even more exactly how about B2B payments work, and which are the very best B2B repayment products for your small company. B2B payments are repayments made between two merchants for items or solutions.

A Biased View of Online Payment Systems

Individuals entailed: There are multiple individuals entailed with each B2B transaction, including receivables, accounts payable, payment, and purchase teams. Payment hold-up: When you pay a close friend or member of the family for something, it's often appropriate on-site (e. g. at the dining establishment if you're dividing a bill) or simply a couple of hours after the event. Merchant Account.

In light of the complexity of B2B repayments, even more as well as extra businesses are deciding for trackable, digital payment options. There are 5 main ways to send as well as get B2B payments: Checks This classification includes traditional paper checks and also electronic checks released by a buyer to a vendor.

The Facts About Ecommerce Uncovered

Each choice differs in ease of use for the sender and recipient, cost, and also security - payment netsuite suitepayments solution. That claimed, the majority of organizations are changing away from paper checks as well as moving toward digital as well as electronic settlements.

An Unbiased View of Ecommerce

Settlements software application and also applications have reports that give you an introduction of your accounts receivable and accounts payable. For instance, if there a couple of sellers that routinely pay you late, you can either impose stricter deadlines find more info or stop working with them. B2B settlement remedies also make it simpler for your clients to pay you, aiding you obtain settlement faster.